50 FQA for foreigner to set up a company in Taiwan, including application, capital funding, taxation, and work permits.

內容目錄

Frequent questions for foreign investor to set up a company in Taiwan.

Q1. Do all the foreign investors need to get approval from the Investment Commission?

A:Yes, all the foreigner investors without Taiwanese resident ID must have reviewed and approved by Investment Commission.

Q2. If I have the Alien Resident Certificate(ARC), do I still need to get Investment Commission’s approval to set up company?

A:Yes, the ARC holders whether is for long-term, short-term, working, relative, ant etc to set up a company need to get approval by Investment Commission.

Q3. If I am currently holding Alien Resident Certificate(ARC) with work permit, can I set up a company in Taiwan?

A:Currently, regulations do not limit that the ARC holder with work permit to set up a company. However, is it acceptable for your current employer if you set up a company?

Q4. If I am studying in Taiwan now, can I set up a company?

A:Currently, the regulation does not restrict the students with study visa to open a company. However, the procedure will take very long time.

Q5. If I have Taiwan R.O.C passport but no resident ID card, do I still to get Investment Commission approval to set up a company?

A:Yes, for those who have Taiwan, R.O.C. passport but no resident ID are defines as Overseas Chinese. The company set up approve by Investment Commission is needed for Overseas Chines.

Q6. What are the documents to be reviewed by Investment Commission?

A:Investment Commission reviews mainly on the investor’s background check, the source of fund, and investment plans etc.

Q7. What are the necessary documents for foreigner to set up a company?

A:The required documents are varied from nations, in generally, the personal identification, the proof of curriculum and background experience, and proof of financial resources are basic documents needed.

Q8. Will Investment Commission reject the foreigner’s investment application?

A:If the investment application complies with the regulations, the government welcomes foreigners to do business in Taiwan.

Q9. Who needs to submit the “Resignation of Nationality”?

A:The foreign investors, who born in mainland China, are required to provide the Resignation of Nationality to proof without the residency in China.

You need to know when set up a company in Taiwan.

Q10. Can foreigners set up a sole proprietorship in Taiwan?

A:Yes.

Q11. Can foreigners set up a joint venture with Taiwanese?

A:Yes, foreigners can form a joint venture with Taiwanese. There are no restrictions on the nationality structure and the numbers of people.

Q12. Can foreigners with various nationality set up a company in Taiwan?

A:Yes, there are no restriction on the nationality structure and number of people.

Q13.Can foreigner set up a business firm?

A:Yes, but the owner of business firm CAN NOT apply for work permit.

Q14.Can foreigners buy new shares through capital increase or acquire existing companies in Taiwan?

A:Yes, foreigners can either buy new shares through capital increase or acquire existing companies in Taiwan.

Q15. Can foreigners open a studio in Taiwan?

A:The are only three types of enterprise: company limited by shares, limited company, and firm. There is NO so-call studio in the regulation, and it can NOT apply for work permit. The studio can only exist as part of company or firm. The owner of the firm can not apply for Manager Work Permit.

Q16. When foreigners set up a company, are there any restriction business activities?

A:Yes, some business activities/scopes are prohibited or restricted such as water supply, manufacture of tobacco products, etc.. (Pleas refers to the link for details.)

Q17.What is a company representative?

A:The person in charge of the company is the representative of the company, represents the company, and is the litigation representative of the company.

Q18. Do I need to set up a company or a branch to open a restaurant or snack bar?

A:No matter what kind of business or shop you want to do, you must set up a company or a firm to operate and manage it.

Q19. It is necessary to have a register address to set up a company in Taiwan?

A:Yes, it is necessary to have a register address. You can use your own house or friend’s address as registered address, or you can choose our virtual business center service with additional fee.

When set up a company in Taiwan, the capital related questions that foreigner investors want to know.

Q20. When foreigners set up a company, are there any capital limitations?

A:No, but if you (here so-called company representative) want to apply for work permit in Taiwan, the capital exceed the NT500,000 can apply for ONE work permit. If the work permit is not necessary in the case, the suggested minimum capital is NT100,000.

Q21. Does investment capital must be remit from abroad?

A:Not necessary, but it is recommended to remit capital from aboard to have completed proof of evidence.

Q22. Can I ask friend or family to remit the capital to my Taiwan’s bank account?

A:No, the capital must be remitted with the applicant /investor’s name to his/ her establishment bank account in Taiwan.

Q23. Can foreigners invest in Taiwan dollars without foreigner currency exchange?

A:Yes, if you can provide the proof for the source of the fund.

Q24. If I invest in New Taiwan dollars as contribute capital, what is needed as the proof of evidence?

A:If the source of fund is the employment income from Taiwan, please provide the tax payment certificate. If it is gift in Taiwan, the proof from the National Taxation Bureau is required. If the source of fund is from sales of securities and/or real property in Taiwan, please provide the relevant supporting documents. (Details please refer to http://www.moeaic.gov.tw/chinese for investment kind and relevant supporting documents).

Q25. Can I carry the foreign currency to Taiwan as investment capital?

A:Yes, but you need to provide the customs and the declaration form during the company registration.

Q26. If I have enough saving in my Taiwan’s bank account, can it be treated as investment capital?

A:The deposit in Taiwan’s bank account must proof the source of fund such as grant from oversea family member, loan from friend, the relevant supporting documents are required.

Q27. When opening the preparatory bank account, do I have to come in person?

A:Many banks stipulate that when opening a bank account, the person in charge of the account must present in the bank with dual certificates. There are only a few banks that can authorize representative to open an account on the behalf of other.

Taxation questions for the foreign investment company

Q28. Does foreign funded company share the same tax rate as resident’s owner? What kind of tax for the business?

A:Yes, all the companies in Taiwan report two types of corporate tax: one is “Business Tax”, it will be declared every two months; another is “Enterprise Income Tax” declared in every May.

Q29. What is “Business Tax” ?

A:Business tax rate is 5% and is declared once every two months. The formula of computation is 5% of the output tax minus input tax. For instance, the output tax is $200 and the input tax is $100, you will declared the business tax amount is $5 [Calculation formula = (200-100)*5%].

Q30. What is Enterprise Income Tax ?

A:Enterprise Income tax rate is 20% and declared annually in every May. The company can base on their size and scope of business to filling the report for the income tax.

Q31. When the company set up procedure is ready, does company representative need to be in Taiwan National Tax Bureau?

A:The company representative needs to be in National Tax Bureau for the first time to purchase the certificate of output tax.

Q32. How does a company report the tax? Is there any easy way to report tax in Taiwan?

A:There are certified accountant or bookkeeping firm provide the tax reporting service with reasonable fee.

FQA for foreigners apply for work permit.

Q33. Can foreigner get(apply) work permit by set up a company?

A:Yes, when set up a new company, the company’s capital exceeds NT 500,000 and foreign capital must account for more than one-third of the total capital can apply for a foreign manager work permit.

Q34. Can a foreigner apply for a work permit by investing in shares or acquiring an existing company in Taiwan by way of capital increase?

A:If the existing company was established within one year, and the capital exceeds NT 500,000 and foreign capital accounts for more than one-third, it can apply for ONE foreign manager work permit. If the existing company has been established for more than one year, the requirement will be the annual sales revenue in the past year has reached NT 3 million to apply for a work manger permit.

Q35. How long is the work permit for a newly set up company’s foreign manager?

A:For the newly established company, the foreign manger’s work permit will be granted among one year to three years depending on the judgement of the Ministry of Labor.

Q36. Can foreigner set up a sole proprietorship, then hire himself/herself or someone else as company foreign manager?

A:Yes. There is no restriction for the nationality of the foreign manger.

Q37. Can foreign manager apply for extension after his/her work pert expires?

A:Yes, the work permit extension policy depends on the company’s turnover. For the company set up more than one year, the average turnover of the recent year or pass three years must reach NT$3 million to apply for the work permit extension.

Q38. Can a company only apply for one work permit? What if there are two shareholders who both want to apply for work permit ?

A:Newly established foreign company whose capital exceeds NT$500,000 and whose foreign investment accounts for more than one-third capital, or company established for more than one year with an annual turnover of NT$3 million or more may apply for one foreign manager work permit. If the company wants to apply for second foreign work permit, the requirement is to increase the amount of capital to NT$5 million or annual turnover reached NT$10 million. (More details: https://ezworktaiwan.wda.gov.tw/Default.aspx )

‘ FQA for foreigners set up company and apply for Alien Resident Certificate(ARC) with work permit.

Q39. After foreign manger obtaining the work permit, does foreign manager can apply for Alien Resident Certificate (ARC)?

A:Yes. after foreign manger obtained the work permit, the foreign manger can apply to the Immigration Department for the Alien Resident Certificate (ARC). The length of ARC period is the same as the applicant’s work permit period.

Q40. Can the family of the foreign manager stay in Taiwan?

A:Yes, the ARC’s holder’s spouse and minor children can apply to stay in Taiwan. But, the spouse can not apply for work permit and the minor children can enroll in Taiwan’s school.

Q41. Will the foreign manager have opportunity to apply for an APRC after obtaining the ARC?

A:In generally, the ARC holders can apply for APRC as long as the holder obtains the ARC for five consecutive year. The only exception is for ARC’s holders from Hong Kong and Macau, who can only apply for long-term residence, but not permanent residence.

Q42. Does foreign manger bear higher individual income tax rate?

A:If you live in Taiwan for more than 183 days in a tax year, you will applvabe the same tax rate as ordinary Taiwanese (starting from 5% ). If the residence is less than 183 days in a tax year, the individual income tax rate is 18%.

Applicable tax rate for non-resident: https://www.ntbt.gov.tw/English/htmlList/677b460f647c4a288625775d5f03c950

Q43. If a student came to Taiwan with study permit, can it be changed to work permit after graduated and set up a company?

A:Yes, when the company set up procedure is completed, and meet the requirement for the work permit. The student can apply for purpose of residency changing from study to work.

Q44. If I have work permit, can I also apply for ARC ?

A:Yes, unless the applicant has the criminal record in Taiwan. Then, the application for ARC will be rejected.

More to ask

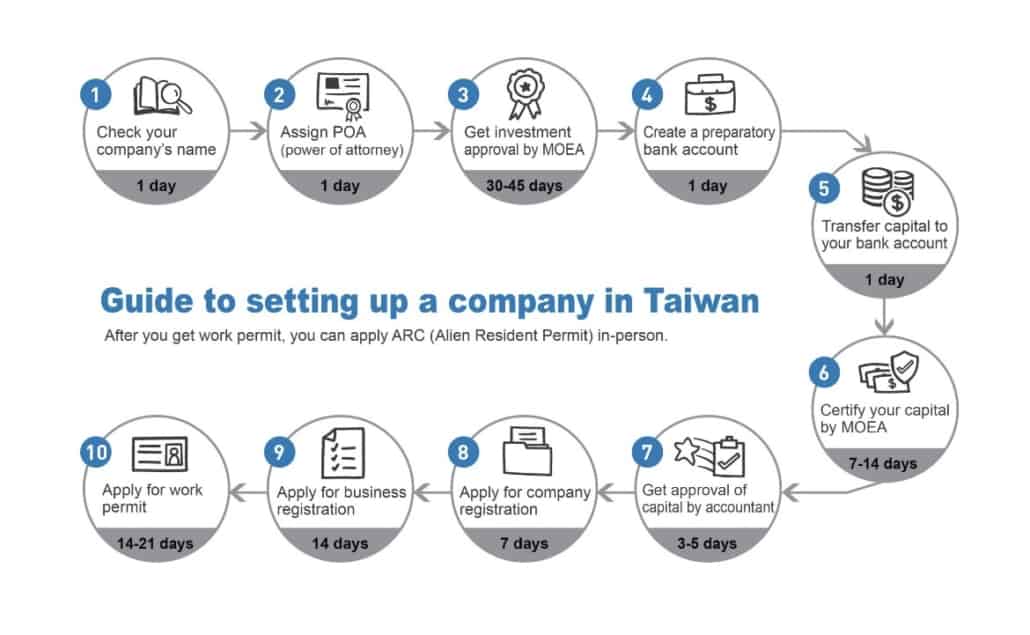

Q45. How long will be taken for a foreigner to set up a company in Taiwan?

A:When all the required documents are ready, the procedure will flow about 2-4 months due to various of working calendar.

Q46. What are the processes for a foreigner to set up a company in Taiwan?

A:The flowchart as following:

The 9 steps for foreigner to get work permit by set up a company.

Q47. Can a foreigner set up a company by himself/herself?

A:Yes, foreign investors can establish the company by themselves. The application include following Government bureau such as Investment Commission, Department of Commerce, Tax Bureau, Ministry of Labor and related departments etc.

Q48. Can I authorize someone to engage in the application for the company set up?

A:Yes, if the foreigner does not have ARC, please provide Power of Attorney letter to agent to act on behalf of application.

Q49. Does the power of attorney (POA) need to be notarized?

A:Yes, the POA need to be notarized by legal law firm with a notary or the applicant’s native country institute or office in Taipei.

Q50. Do all the documents provided by the investment applicant must be translated into Chinese?

A:All the documents must be provided in either English or Chinese language.

Q51.Does investor must come to Taiwan to set up the company in person?

A:If the investor is the representative of the company, the investor needs to present in person when applying the bank account and when the verification by the National Tax Bureau. (Flowchart step. 4 and 9)

Why do foreign entrepreneurs choose us to assist with company startups in Taiwan?

Our team members consist of Taiwanese and foreign status. We have more than ten years expertise in foreign companies’ establishment, and we are familiar with government regulations. We are committed to providing one-stop services from foreign company establishment, office rental, tax and accounting issue, etc.

Also, we have served customers successfully from: Malaysia, Singapore, Hong Kong, Macau, Japan, Korea, Thailand, the United State, the United Kingdom, Egypt, Vietnam, Indonesia, Israel, India, Australia, Iran…….