Company registration

Company registration

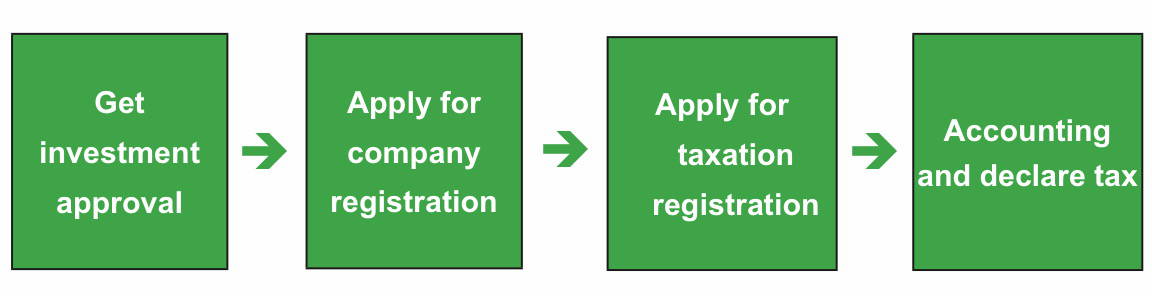

To start a business in Taiwan, you must establish a company, which requires two separate registration procedures: 1. Register the establishment of your company with the local government, through which you will obtain a “Unified Business Number”; 2. Register as a “Business Entity” with National Taxation Bureau to complete taxation registration.

You do not need a qualification to embark on those procedures, which have been much simplified over the years. But for an inexperienced business owner, it still involves a decent amount of detail-oriented paperwork. Any missing or incorrectly-filled documents will cause you to start over and refile. True, you may end up saving a little money but spending much of your time on unexpected hassle. Our service helps you establish your company at a reasonable price with minimum efforts on your side, allowing you to focus on developing your business!

✅ One-stop service at one flat rate: Company name pre-check, capital auditing by certified accountants, company stamps engraving, establishment registration with local government, and taxation registration with National Taxation Bureau.

✅ Our service scope includes company (firm) registration, changes, relocation, capital increase, or licensing.

✅ Expertise in obtaining licenses: Success records with travel agencies, pharmacies, tobacco and alcohol importers, transportation operators, engineering consultants, and medical equipment distributors.

✅ The business you are engaged in belongs to a special industry

✅ Letting us act on your behalf saves you valuable time. Company registration or capital increase requires auditing by a certified accountant, and our collaborating accountants stand ready to provide you with timely assistance.

One-stop service for one flat rate |

Limited companies/companies limited by shares |

Firms |

Registration of a company with foreign capital |

Registration changes |

FROM NTD$8,000 |

FROM NTD$6,000 |

FROM NTD$30,000 |

FROM $6,000 |

| Limited companies/companies limited by shares |

| FROM NTD$8,000 |

| Firms |

| FROM NTD$6,000 |

| Registration of a company with foreign capital |

| FROM NTD$30,000 |

| Registration changes |

| FROM NTD$6,000 |

| * The above rate is inclusive of company name pre-check, capital auditing by certified accountants, company stamps (incl. invoice stamp) engraving, establishment registration with local government, and taxation registration with National Taxation Bureau and is subject to 5% Business Tax. |

Registration of companies with foreign capital

We have an impeccable record in helping foreign investors from all over the world establish companies in Taiwan (including those from Hong Kong, Macau, Vietnam, Malaysia, the US, the UK, Thailand, Turkey, Singapore, Indonesia, and India). For that, we have designed a streamlined process to expedite your registration procedure.

“Registration of Companies with Foreign Capital + Work Permit for Managers” (Applicable to citizens of Hong Kong, Macau, Malaysia, and other countries)

A company with at least 1/3 of the capital and above NTD 500,000 owned by a foreign entity may apply for one work permit to allow a foreign manager to legally work in Taiwan for 1-3 years (subject to approval by the Ministry of Labor). Invested capital can be used for operation once the company has been established.

★★ Notes ★★

【Tips 1】

✅ A foreigner can act as the sole proprietor of the company.

✅ Joint ventures are also allowed, in a mix such as NTD 300,000 foreign + NTD 200,000 domestic.

✅ A foreign shareholder can employ himself as the manager or hire a person of other nationality, such as a company jointly owned by Taiwanese and Malaysian shareholders hiring a Thai manager.

【Tips 2】

✅ No requirement on wage, education, or professional experience

✅ Spouse and minor children can apply for dependent residency in Taiwan.

✅ A foreigner can apply for permeant residency upon having resided in Taiwan for more than five years. Hong Kong and Macau citizens can only reside in Taiwan during the validity of the work permit (not eligible for permanent residency or naturalization).

✅ The extension of a work permit is dependent on the company’s revenue. As law stipulates that “for companies that have been established for over one year, only those with a yearly revenue in the most recent year or an average yearly revenue in the past three years exceeding NTD 3 million” can extend the work permit for its manager.

Article Link:

One-stop service specifically designed for foreign investors |

Registration of a company with foreign capital |

Registration of a branch |

FROM NTD$30,000 |

FROM NTD$30,000 |

| Registration of a company with foreign capital |

| FROM NTD$30,000 |

| Registration of a branch |

| FROM NTD$30,000 |

| * The above rate is inclusive of company name pre-check, capital auditing by certified accountants, company stamps (incl. invoice stamp) engraving, establishment registration with the local government, and taxation registration with National Taxation Bureau and is subject to 5% Business Tax. |